Shepherd M (2018) U.S. Drug Importation: Impact on Canada’s Prescription Drug Supply. Health Econ Outcome Res Open Access 4: 146.

This research paper (available here in pdf form) is an update to the 2010 paper, The Effect Of US Pharmaceutical Drug Importation On The Canadian Pharmaceutical Supply.

By:

Marv Shepherd, Ph.D., Professor Emeritus, College of Pharmacy, University of Texas at Austin

And

President Board of Directors, Partnership for Safe Medicine

Email: marvshepherd@austin.utexas.edu

Submitted on August 9, 2017

Abstract

Background and Objectives

In 2010 I wrote and an article and published in Canadian Pharmaceutical Journal which examined the impact U.S. drug importation will have on the Canadian prescription drug supply. Currently, many U.S. politicians have renewed their interest and are strongly advocating the legalization of prescription drug importation. The objective of this research is to examine the issue and estimate the impact U.S. drug importation from Canada will have on the Canadian prescription drug supply.

Methods

Like the 2010 article, a forecasting model was created using the baseline numbers from the number of Canadian and U.S. prescriptions dispensed in 2015. Two models were employed: one for all prescriptions and one for brand name prescriptions dispensed. Based on these results, the number of days to exhaust the Canadian prescription drug supply was estimated by varying the proportion of U.S. prescriptions demanded from Canada based on average prescription drug use per person.

Results

The model found that if 20% of the U.S. prescriptions were filled using Canadian prescription drug sources, the 2015 Canadian drug supply would be exhausted in 183 days and this is calculated using a added supply of 20%. It was believed that U.S. demand for Canadian brand name drugs will be much higher than for generic drugs since generic drugs are substantially cheaper in the U.S. Thus, a Canadian brand name drug model was constructed. The results showed that a 20% demand from the U.S. for patented drugs would deplete the Canadian 2015 brand name drug supply in 201 days.

Conclusion

The results show the risks are high for the Canadian health system if the U.S. were to legalize drug importation. Canada will need to either have a major increase in drug imports or dramatically increase their domestic drug manufacturing. The paper discusses four possible options for Canada to avert a prescription drug shortage.

Introduction

In 2010, the Canadian Pharmacists Journal published my paper examining the impact on Canada’ prescription drug supply if U.S. legalized drug importation.[1] During the early 2000’s, many bills were introduced in U.S. Congress to legalize drug importation primarily from Canada, but other countries as well. Even both 2008 presidential candidates voiced support for drug importation; however, both candidates softened their stance when it got closer to the November election. The primary reason was the threat of importing substandard drug products.[2]

Today, we are facing similar drug importation legislative initiatives. While the current president called for drug importation during his campaign, he has not publicly stated support for the legislative initiatives proposed. On the legislative side, Senator Bernie Sanders’ bill, S.469: Affordable and Safe Prescription Drug Importation Act is the major drug importation bill of interest. Sander’s bill is not just about drug importation from Canada, it opens up drug importation from other countries as long as FDA certifies the exporting entity seeking to import drugs into the U.S. However, the bill’s major focus is on obtaining drugs from Canada. In addition, it also allows for both personal and commercial drug importation.

With personal drug importation, a U.S. resident can travel to the country to purchase the drug product or can purchase the drug product via mail or internet pharmacy website. Pharmacies selling the drug products would have to be “certified” or “authorized” by FDA. The foreign pharmacy would be “authorized” to provide drugs to U.S. residents and providers must be licensed by the country/province where they are located. Drug products need approval from the country where the provider is located.

Currently, personal drug importation is illegal; however, US officials realize that this is very difficult to enforce. Thus, FDA set up variances for enforcing the law. U.S. Customs officials permit individuals to import drugs as long as the product does not represent an unreasonable risk, it is for personal use only and for a non-controlled product, not more than a 90-day supply can be imported. For commercial volumes and usage, only drug manufacturers and U.S. licensed drug importers are allowed by law to import pharmaceuticals into the U.S.

Sander’s bill will legalize commercial drug importation for U.S. wholesalers, distributors, retail pharmacies, and other licensed commercial pharmacy entities. That is, U.S. commercial entities will be allowed to purchase from foreign “FDA certified” pharmaceutical sources. Thus, the foreign entities seeking to export drugs to the U.S. through Canada will need to be FDA approved. Under Sander’s proposed legislation, the drug product needs approval by the foreign country where the exporter is located. Thus, for a Canadian facility, the drug will need to be approved by, Health Canada. The drug will not have to have U.S. FDA approval.

The main driver for drug importation is the high price of prescription drugs in the U.S. While high drug prices has been primarily brand name drugs issue, price hikes in some generics are also becoming a factor in the debate. The U.S. public wants access to cheaper prescription drugs and with many countries having governmental price controls, some drugs are much cheaper when compared to the U.S.[3] For example, on average brand name drugs in Canada run from 35% to 55% lower than in the U.S. Another reason for the price discrepancy between countries is that pharmaceutical manufacturers use a segmented marketing strategy. That is, they charge different prices to different countries, based on the economic status and purchasing power of the people in the country. Segmented marketing is used in the U.S. when firms offer senior citizen discounts at retail establishments, for airplane tickets or in restaurants. The key to segmented or differential marketing is that arbitrage does not occur; that is, the buyers at the low price do not resell the goods. If so, the chance of losing the discount is likely.

As debated a decade ago, drug importation issues have not changed. The main concerns voiced are drug quality/safety, drug equivalency and the threat of counterfeit drugs. These issues have gained most of the lay press attention. What has changed in the last ten years is the political climate; the American public is very upset with the pharmaceutical industry’s high drug prices for brand name products and they see lower drug prices in other countries and want access to these products.

The one issue that has not received much press attention is the impact U.S. drug importation will have in Canada. Does Canada have the pharmaceutical supplies to become the drugstore for America? A decade ago, I looked into this question and concluded that Canada does not have the drug supply and cannot risk the drug shortages to become the drugstore for Americans. Canada’s drug supply is too limited to support U.S. personal and commercial drug importation. Just a small proportion of the U.S. population demanding drugs from Canada would devastate Canada’s drug supplies. Does this still hold true today?

Methodology

Unless otherwise designated, the dollar amounts expressed will be U.S. dollars (US$). The designation for Canadian dollars is CN$. For 2015, the Canadian to U.S. yearly exchange rate used was 1.329.[4] To convert Canadian dollars to U.S. dollars divide Canadian dollars by the exchange the rate.

North American Industry Classification System (NAICS)

The NAICS is a consistent system for economic analysis across the three North American Free Trade Agreement partners: Canada, Mexico, and the U. S. NAICS is based on a production-oriented or supply-based conceptual framework in that establishments are grouped into industries according to the similarity in the processes used to produce goods or services. For the pharmaceutical manufacturing industries, the primary NAICS code employed in this report is 3254.[5]

Harmonized Schedule (HS)

The HS is an international classification coding system for imports and exports and the codes are standardized between countries at a basic 6-digit level. HS Schedule B provides export information on 8,000 commodities.[6] The import statistics provide information on 14,000 commodity classifications. The U.S. International Trade Commission (USITC) administers the HS schedule Codes.

Due to the proprietary nature of the import and export information, HS codes are used for specific drug product groups. For example, HS codes represent categorizations of products such as cardiovascular or anti-depressant medicaments. The 4-digit HS code most frequently used in this report is HS 3004, which represents pharmaceuticals dispensed in community and hospital pharmacies. The code definition follows:

Medicaments (not goods of heading no. 3002, 3005 or 3006) consisting of mixed or unmixed products for therapeutic or prophylactic use, put up in measured doses (incl. those in the form of transdermal admin. systems) or packed for retail sale.[7]

This designation was used because it was believed that it best reflects drug products for consumer use, rather than using an overall bulk pharmaceuticals and medicines product code.

The Canadian Annual Survey of Manufacturers (ASM) was the source for the dollar value of domestic pharmaceutical manufacturing, including exports and imports in Canada.

Model Construction and Results

Canada’s population is one-ninth the size of the U.S. Canada’s 2015 population was 35 million, whereas the U.S. population was 318 million. The total number of prescriptions dispensed in Canada in 2015 was 626.7 million or 1.717 million prescriptions per day.[8] The number of U.S. prescriptions dispensed in 2015 was 4.368 billion or 11.967 million a day.[9]

The average number of U.S. prescriptions dispensed per person in 2015 was 13.735 (4,368 million prescriptions/318M U.S. population). If 20% of the U.S. population, which is 63.6 million people, were to get their prescriptions from Canada, the annual prescription demand from the U.S. would be 877.68 million prescriptions per year (64.8 million X 13.8 prescriptions per person per year). This demand is greater than the total number of prescriptions dispensed in Canada in 2015, which was 626.7 million prescriptions.

The daily prescription demand from the 20% U.S. residents is 2.393 million prescriptions per day. Combine this daily demand with the Canadian daily demand, the total daily demand for prescriptions in Canada is 4.11 million prescriptions a day (1.717 million prescriptions for Canadians + 2.393 million prescriptions from the U.S.). Thus, the daily demand for drugs from Canadian pharmacies will more than double (4.11 versus 1.717) if just 20% of the U.S. population obtained their prescription drugs from Canada. The 20% is a conservative estimate considering the proposed drug importation legislation allows for both personal and commercial importation. It is expected that over time the U.S. demand for prescription drugs from Canada will continue to escalate.

Prescription Supply Days

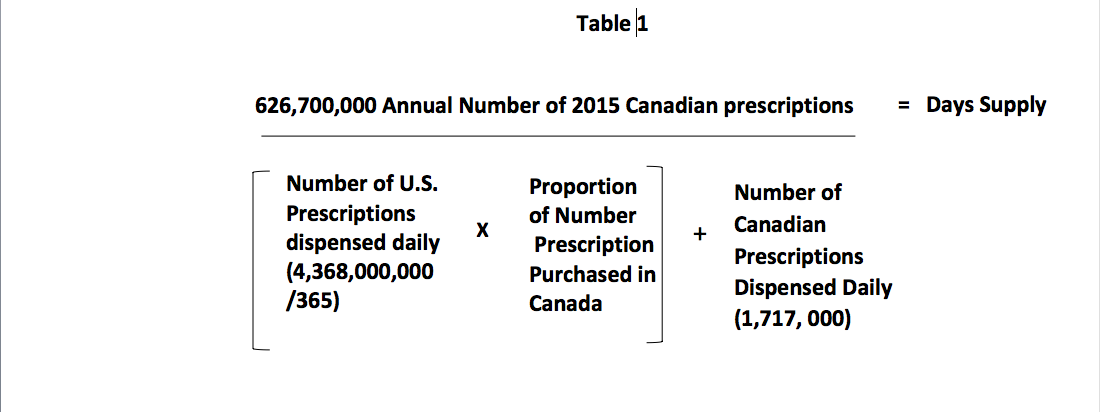

Another way to look at this is to calculate the number of days the 2015 Canadian prescription drug supply will last if 20% of Americans obtained their drugs from Canada. The mathematical model used to determine the number of supply days for prescription drugs is depicted in Table 1.

If 20% of the U.S. prescriptions came from Canada, 2,393,000 prescriptions will be added to the Canadian daily demand. Canada dispensed 1,717,000 prescriptions per day in 2015 for Canadians and when you add that to the 2,393,000 prescriptions from the U.S., the total daily demand is 4,110,000 prescriptions per day. When you divide the annual number of prescriptions dispensed in Canada in 2015 by the daily demand you arrive at 152.5 days supply. Thus, the 2015 Canadian drug supply would be exhausted in five months if just 20% of the U.S. prescriptions were added.

Obviously, the above calculation does not include any extra or a surplus supply of prescription drugs. Pharmacies in Canada do not dispense their last pills on a monthly basis; of course, they keep an additional supply on hand which must be used when considering the time it would take to fully drain the Canadian drug supply. In other words, the total Canadian drug supply is larger than the number of prescriptions dispensed in 2015. To accommodate this, a 20% surplus in supply was added to the total number of prescriptions dispensed in 2015, making the number for prescriptions dispensed 752.04 million. The 2015 number of drug supply days now becomes 182.97 days, instead of 152 days. Thus, the 2015 Canadian prescription drug supply will last approximately six months when the U.S. demand for Canadian prescription drugs is 20% when calculated with a 20% surplus. Of course, this number represents an overall average of all prescription drugs and drugs of high demand form the U.S. may be exhausted much sooner causing shortage.

Figure 1 depicts the trend in days’ supply of prescriptions controlling for the proportion of drugs demanded by the U.S. If 40% of the U.S. prescriptions came from Canada, the 2015 drug supply in Canada is projected to be exhausted in 116 days.

Model for Brand Name Drugs Only

As mentioned earlier, the demand for prescription drugs by U.S. residents will primarily be for brand name drugs not generic drugs. On average, generic drugs are more expensive in Canada compared to the U.S.[10] One study found that U.S. generic drug prices were 57% less when compared to Canadian generic drug prices.[11] While the Canadian government has been successful in decreasing their high generic drug prices since 2010, generic drug prices are still lower in many other countries including the U.S. when compared to Canada. [12]

In 2015, 68.6% of the prescriptions dispensed in Canada were for a generic drug (429.916 million generic prescriptions). Generic drug use in the U.S. is much higher; iIn 2015, 88.7% of the U.S. prescriptions filled used a generic drug (3,874,416 billion prescriptions).[13] Using a similar model as before, the number of supply days for brand name drugs was calculated.

Using the above proportions, 31.4% or 196.784 million prescriptions were for brand name drugs in Canada. In the U.S., only 11.3% or 493.584 million prescriptions used brand name products. The daily use numbers for Canada and U.S. were 539,134 prescriptions per day for Canada and 1,352,284 brand name prescriptions per day for U.S.

As before, an additional 20% supply was added to the model. Thus, the total annual number of brand name prescriptions is now 236.140 million prescriptions (1.2 x 196.784 million). As noted above, the daily demand from Canadians for brand name products was 539,134 prescriptions and if 20% of the U.S. brand name prescriptions came from Canada, the U.S. daily demand would be 270,456 additional brand name prescriptions (0.2 x 1,352,284 prescriptions). Thus, the total daily demand for brand name prescriptions is 809,590 brand name prescriptions per day (270,456 + 539,134). If the 20% of the U.S. brand name prescriptions were sourced from Canada, the number of supply days for brand name drugs in Canada is 243 days. Figure 2 depicts the number of supply days controlling for the proportion of U.S. brand name prescriptions demanded. If 40% of U.S. brand name prescriptions came from Canada, the 2015 Canadian prescription drug supply would be exhausted in approximately six months.

A decade ago, a 20% demand on the Canadian drug supply by Americans resulted in a 201 day supply before it was depleted. The most likely reason why the supply days increased is that in the last decade fewer Americans are using brand name drugs. In 2007, 32.7% of the U.S. prescriptions were for brand name drugs, three times larger than today’s use.

Discussion and Implications

Recent survey evidence shows that obtaining prescription drugs from Canada is strongly supported by Americans.[14] [15] A recent Kaiser poll found that two-thirds of the respondents were in favor of American buying drugs from Canada.[16] Thus, it is highly probable that if enacted, Americans will pursue Canadian pharmaceuticals. The risk to Canada is very evident.

To meet the U.S. demand, Canada does have some options. First, Canada can dramatically increase their domestic drug manufacturing output. Second, Canada can increase drug importation for U.S. and other countries. A third option is to continue to look the other way and allow Canadian operators to obtain medications for foreign sources that most likely will not pass Canadian inspection and deliver them directly to American patients without bringing them into Canada at all. Obviously, some or all of these approaches will be needed to meet the added demand. There is final option and that is Canada puts a halt to providing their domestic drug supply to American customers.

In 2015, Canada imported US$ 13.180 billion in pharmaceuticals with US$ 5.16 billion coming from the U.S. These numbers include bulk and measured dosage form drugs. Probably a better classification is to use the Harmonized System Code 3004 which is for pharmaceuticals “put up in measured doses or packed for retail sale.”[17] In 2015, the value of Canadian pharmaceutical imports (HS 3004) was US$ 7.228 billion and the U.S. was the largest supplier of drugs to Canada with US$ 2.40 billion. In other words 33.1% of the drugs imported by Canada came from the U.S.[18] Figure 3 depicts the trend in Canadian drug imports since 2007. U.S. drug exports to Canada have remained 20% to 30% of the Canadian imports for the last decade.

Source: Government Report, Trade Online, Web site: https://www.ic.gc.ca/app/scr/tdst/tdo/crtr.html?naArea=9999&searchType=KS_CS&hSelectedCodes=%7C3004&productType=HS6&reportType=TI&timePeriod=5%7CComplete+Years¤cy=US&toFromCountry=CDN&countryList=specific&areaCodes=9&grouped=GROUPED&runReport=true

Canadian pharmaceutical manufacturing (NAICS Code 3254) had sales of C$24.6 billion (US$ 18.5 billion) in 2015 with 87.5% of this total sold to retail pharmacies or US$16.1 billion.[19] Generic drugs comprise 38.2% of the total. Their domestic pharmaceutical exports (HS3004) in 2015 were U.S.$6.3 billion[20] which leaves US$ 9.8 billion for domestic use. Approximately 70% of the Canadian pharmaceutical exports go to the U.S.

Canada manufacturers produce US$ 9.8 billion of pharmaceuticals for domestic use. When domestic production is combined with pharmaceutical imports and re-exports (imported products but later exported without a substantial change to the product) subtracted, the result is Canada’s pharmaceutical value for domestic use. The 2015 value of the pharmaceutical re-exports (HS 3004) was US$ 410.0 million. Thus, the total pharmaceutical value for Canadian domestic use is US$ 16.618 billion for Canada in 2015 (US$9.8 billion Canadian manufactured drugs + US$7.228 billion drug imports – US$0.410 billion for re-exports). With drug importation, these numbers will have to more than double if Canada is to meet U.S. demands.

There is one potential and major problem with Canada obtaining additional drugs from the U.S. It is highly unlikely that U.S. pharmaceutical firms will increase their supplies to Canada due to the arbitrage. Firms may restrict their drug supplies to meet Canadian health system needs only, and not U.S. demands. Pharmaceutical manufacturers have agreed to the Canadian governmental price controls, but not when it applies to the much larger U.S. market. The threat is much larger with commercial importation when U.S. based wholesalers and chain pharmacies purchasing large quantities of governmental price controlled pharmaceuticals from Canada for the U.S. market. They purchase the drugs at an artificially produced lower cost and resell them at a much higher cost. Profit taking by a host of intermediaries (wholesalers, and distributors) and retail outlets could be enormous. There is no guarantee that much of price reduction will ever be passed on to the U.S. public.

Canadian Pharmaceutical Manufacturing and Research

Canadian pharmaceutical manufacturing has had a slow annual growth profile, only growing 0.9% since 2010. In addition, from 2000 to 2015 research and development spending by the Canadian pharmaceutical industry has fallen 20%. In 2015, the industry spent CN$870 million (US$ 654.6 million) on research and development.[21] As a comparison, U.S. pharmaceutical companies expended US$ 58.4 billion on research and development.[22]

Limitations and Problems with Added Canadian Drug Importation

If Canada suffers from drug shortage issues due to the new the U.S. market, the option for Canada to is find other non-U.S. sources for importing drugs. Some of these suppliers may be from high quality regulated European sources, but others may not be. Be assured that there will be many varying quality drug suppliers from around the world offering drugs to Canada to handle the shortage. Some products will be good quality products, however others will not. There will be the threat of importing substandard and counterfeit products. Thus, increasing the risks to both Canadians and Americans.

One also cannot rule out that Canada may limit or halt the exportation of pharmaceuticals to the U.S. This option was frequently mentioned a decade ago when the threat of legalizing drug importation from Canada last arose.[23],[24] In fact, at that time the Canadian Health Minister stated: “Canada cannot be the drugstore for the United States of America.”[25],[26]

Conclusion

After reviewing the most recent data, I would not change the conclusions I reached in my 2010 paper. The following is a summary.

- The risks are high for the Canadians and Canada’s health care system if the U.S. were to legalize drug importation. The result could be devastating for Canada.

- Canada faces added risks of importing substandard or counterfeit pharmaceuticals which will be needed to make up for the portion of domestic supply sent to the U.S. Drug suppliers of varying quality from around the world may be offering and selling drug products to Canada. The risk of obtaining a substandard or counterfeit drug product is higher for both Canadians and U.S. residents purchasing Canadian products because the regulatory control varies widely among source countries.

- The increase in U.S. demand for Canadian drugs may have unexpected results on the Canadian healthcare market, including forcing an increase in Canadian drug prices, especially if the drug supplies do not meet demands.

- Canada may elect to ban or severely limit drug exports to U.S. residents (personal importation), and, if necessary, ban or limit commercial drug exportation.

The solution for the high drug prices in the U.S. is not importing another country’s pharmaceuticals and threatening their drug supplies. The U.S. solutions are in tackling the problems at home. This means opening up competition, cutting excessive governmental regulations, finding ways to improve and shorten the pharmaceutical development process, shorten the drug approval process, drugs especially for generic drugs and improve the transparency and get control over insurance providers, managed care and pharmacy benefit management firms.

[1] Shepherd, Marv, Effect of US Pharmaceutical Drug Importation on Canadian Pharmaceutical Supply, Canadian Pharmacists Journal, vol.143, no.5, September/October 2010, 226-233. http://www.safemedicines.org/2010/09/shepherd-md-the-effect-of-us-pharmaceutical-drug-importation-on-the-canadian-pharmaceutical-supply-c.html

[2] “Rx Importation’s Appeal for Sen Obama Wanes as Safety Concerns Rise,” The Pink Sheet: Prescription Pharmaceuticals and Biotechnology, Vol. 70, No. 42, October 20, 2008, p. 14.

[3] Langreth, Robert, Migliozzi Blacki, Gokhale Ketaki, "The U.S. Pays a lot More for Top Drugs Than Other Countries," Web site: https://www.bloomberg.com/graphics/2015-drug-prices/ December 18, 2015. Accessed April 10, 2017.

[4] “Yearly Average Exchange Rates Translating Foreign Currency to U.S. Dollars,” Web site: https://www.irs.gov/individuals/international-taxpayers/yearly-average-currency-exchange-rates Accessed April 5, 2017.

[5] National Code Description, 325412 Pharmaceutical Preparation Manufacturing, Web site: https://www.naics.com/naics-code-description/?code=325412 Accessed April 4, 2017.

[6] Export Product Classifications, https://www.export.gov/article?id=Find-HS-Code Accessed March 27, 2017.

[7] Foreign Trade, Harmonized System Codes (HS Codes 2017), Web site: http://www.foreign-trade.com/reference/hscode.htm Accessed March 27, 2017.

[8] Benefits Canada, Looks at the Top 25 Drugs, Web site: http://www.benefitscanada.com/news/a-look-at-the-top-drugs-of-2015-84998 Accessed March 30, 2017.

[9] The total Number of Prescriptions Dispensed in the US from 2009 to 2015, Web site: https://www.statista.com/statistics/238702/us-total-medical-prescriptions-issued/ Accessed March 30, 2017.

[10] Bren, Linda, “US Generic Drugs Cost Less than Canadian Drugs,” FDA Consumer Article, July August 2004, Web site: https://www.fda.gov/Drugs/EmergencyPreparedness/BioterrorismandDrugPreparedness/ucm134441.htm Accessed April 10, 2017.

[11] Patented Medicine Prices Review Board, Government of Canada, “Generic Drugs in Canada: International Drug Price Comparisons and Potential Cost Savings,” Web site: http://www.pmprb-cepmb.gc.ca/view.asp?ccid=870 Accessed April 10, 2017.

[12] Patented Medicines Prices Review Board, National Prescription Drug Utilization System, “Generics 360, Generic Drugs in Canada,” February 2016. P.10, Web site: http://www.pmprb-cepmb.gc.ca/CMFiles/NPDUIS/NPDUIS_Generics_360_Report_E.pdf Accessed April 10, 2017.

[13] Canadian Generic Pharmaceutical Association, Sustainable Healthcare, Market Trends, Web site: http://canadiangenerics.ca/sustainable-healthcare/market-trends/ Accessed April 10, 2017.

[14] Bluth, Rachel, “Faced with Unfordable Drug Prices Millions Buy Medicines Outside the U.S.," Kaiser Health News, December 20, 2016, Web site: https://www.statnews.com/2016/12/20/drug-prices-us-importing/ Accessed March 12, 2017.

[15] Thompson, Dennis, “Americans Sick of Soaring Drug Prices: Health Day/Harris Poll,” October 27, 2016, Web site: http://www.upi.com/Health_News/2016/10/27/Americans-sick-of-soaring-drug-prices-HealthDayHarris-Poll/5691477584337/ Accessed April 10, 2017.

[16] Rau, Jordan, “Poll Finds the Majority of Americans Want Restraints on Drug Prices,” Kaiser Health News, September 26, 2016, Web site: http://khn.org/news/poll-finds-majority-of-americans-want-restraints-on-drug-prices/ Accessed April 11, 2017.

[17] Canada Border Service Agency, Tariff Classification of Medicaments Including Natural Health Products, (HS Codes 2017), Web site: http://www.cbsa-asfc.gc.ca/publications/dm-md/d10/d10-14-30-eng.html Accessed April 10, 2017.

[18] Government of Canada, Report-Trade Data Online, Web site: http://bit.ly/2JUYBH5 Accessed April 12, 2017.

[19] Government of Canada, Pharmaceutical Industry Profile, Web site: file:///C:/Users/MDS623/Documents/Marv's%20Documents/Canadian%20Pharmaceutical%20industry%20profile%20-%20Life%20science%20industries.htm Accessed April 12, 2017.

[20] Government of Canada, 2016 Top Markets Report Pharmaceuticals Country Case Study: Canada, Web site: http://www.trade.gov/topmarkets/pdf/Pharmaceuticals_Canada.pdf Accessed August 9, 2017.

[21] Government of Canada, Pharmaceutical Profile, Web site: file:///C:/Users/MDS623/Documents/Marv's%20Documents/Canadian%20Pharmaceutical%20industry%20profile%20-%20Life%20science%20industries.htm Accessed April 12, 2017.

[22] Statista, Research and Development Expenditure of Total U.S. Pharmaceutical industry from 1995 to 2015, Web site: https://www.statista.com/statistics/265085/research-and-development-expenditure-us-pharmaceutical-industry/ Accessed April 12, 2017.

[23] Best Medicines Coalition, Exportation of Medicines from Canada to the United States, Web site: http://www.safemedicines.org/wp-content/uploads/3-BMC-pharmaceutical-exportation-statement-March-2016.pdf Accessed April 14, 2017.

[24] Struck, Doug, “Canada to Restrict Exports to U.S. of Prescription Drugs, Washington Post," June 30, 2005, Web site: http://www.washingtonpost.com/wp-dyn/content/article/2005/06/29/AR2005062901632.html Accessed April 14, 2017.

[25] Appleby, Julie, “Canada May Tighten Rules on U.S. Drug Purchases”, USA Today, June 29, 2005, Web site: https://usatoday30.usatoday.com/money/industries/health/drugs/2005-06-29-canada-drugs_x.htm Accessed April 12, 2017.

[26] Minerd, Jeff, "Canada May Ban Bulk Drug Exports to U.S.," Medpage Today June 30, 2005, Web site: https://www.medpagetoday.com/publichealthpolicy/healthpolicy/1298 Accessed April 14, 2017.